Why These Two OneStream XF Reports Could Save You Hundreds of Person- Hours a Year

Written by: C. Benjamin Cornforth

One of the fundamental challenges of Record to Report is in understanding both the Quantitative and Qualitative nature of our financials, and in doing so to strive for greater precision in the former, while maximizing the latter.

The truth that you hear whispered when you are around Finance & Accounting professionals is that it is common, even frequent, to publish Financial Statements without knowing to a certainty that (1) the quantitative elements expressed are truly reflective of the nature of the business, or more often (2) that the completeness and accuracy of the work performed to arrive at these conclusions is supported in the processes that underpin the data.

There are a couple of reasons for this challenge. The first is in most cases the quantitative data (e.g., the initial pass at the Balance Sheet or Income Statement) are most often presented without an understanding as to the completeness of the underlying work that supports them. Consider that when we are presented with a Balance Sheet, do we have contemporaneous knowledge of the status of the Close Tasks, Reconciliations, Journals and other activities that support those numbers? In most cases, “No” we do not. The second challenge is that invariably when we have our Close Status meetings, the reports that are key to gaining this oversight are generated at different times and from different systems. It is not at all atypical for the current Balance Sheet or Income Statement to come directly from some financials package or ERP system, while the Close Task checklist is kept on a spreadsheet in a local computer. Logically a question relating to the numbers then requires accessing multiple systems.

When pressed many Finance and Accounting Professionals will readily admit that it is because of the disjointed nature of the Close that we sometimes endure multiple Close Status Meetings and dozens of side-bar conversations each day during the peak work-days. Without a single source of the truth, to provide us with perspective on the quantitative and the qualitative, we seek to reduce our risk and build our confidence by meeting and talking through these items. A dear CAO friend of mine used to refer to this as the “blink-test”, having somehow become an expert and body language and guarded commentary. There is a better way…a much better way.

For years technology companies have been trying to provide this single view into Record to Report operations. The problem was that enterprises either had to commit wholly and completely to a platform like SAP or Oracle, or feed every account regardless of their source system into a separate Close-Reconciliation solution and then wait patiently while balances were loaded from all of the source systems. Neither approach is particularly appealing in a business environment that moves at speed and where you might acquire a company (and its attendant systems) one day and spin out a division the next.

OneStream Software has finally provided the innovation for a workable solution to this challenge and in doing so has allowed Finance and Accounting personnel to claw-back potentially hundreds of person-hours per year. Fewer Close meetings and hallway discussions means that we can now focus on addressing the exception, risk and narrative around our Financials as opposed to chasing items down.

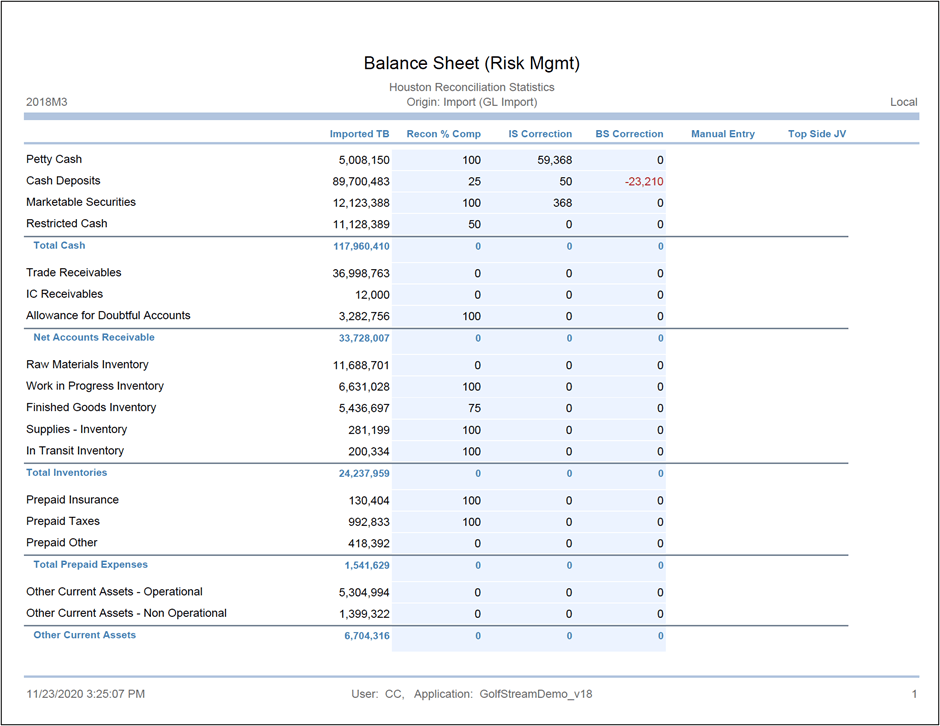

Fig 1: OneStreamXF Balance Sheet Risk Management Report

Figure (1) reflects a comprehensive real-time view into the status of the Balance Sheet during the Close itself. What make this report different than our standard flash report, is that it also reflects the completeness of Account Reconciliation activity, finally providing some context to the numbers. This specific example goes further in that it shows adjustments both to the Balance Sheet as well as the Income Statement, tabulates Manual Adjustments and even shows if there have been Top-Side Adjustments. Imagine having this report at your finger-tips, no more having to find the needle in the haystack or cross-reference multiple systems. It is all right there, or is it?

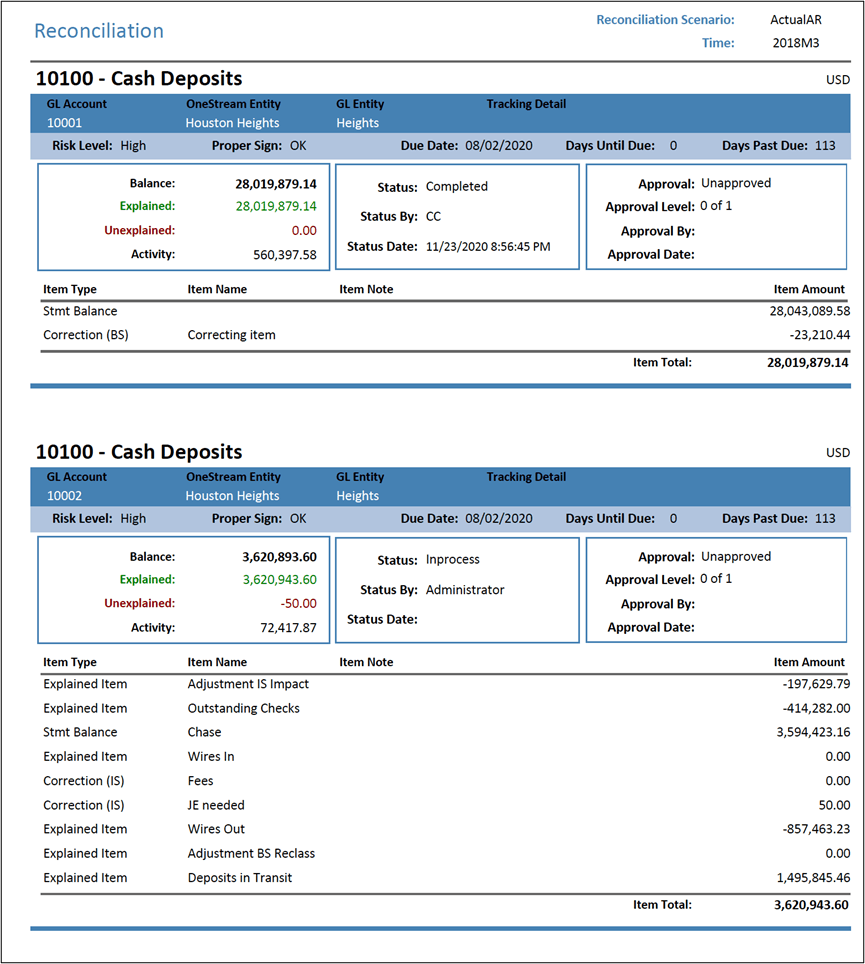

Fig 2: OneStreamXF Balance Sheet Risk Management Report- Detail Drill Through

The report in Figure (1) actually has some hidden value to it, in that each one of the status lines is drillable to the underlying compositional data, as represented in Figure (2). Imagine being able to introspect into the numbers in real-time and then with a single click unpack the status of all of the Close Tasks and Reconciliations that comprise the Financial Statement line items themselves. From here we can even go a step further dropping into the Reconciliation itself in order to tease apart the Rec itself, viewing the support, the commentary, as well as the approval audit trail.

Prior to OneStream the only way to achieve this sort of broad and deep view into the Close was to run reports from multiple systems simultaneously and then to view them side by side. But the keen eye will notice that even that exercise does not provide the depth necessary to assess root cause exceptions. The capacity to drill-through to the underlying data provides not just the “what”, but also the “why”.

Because OneStream provides this ability to unify multiple data sources and to consolidate results natively within the application, it provides that single source of the truth from a quantitative perspective. Moreover, because OneStream is able to capture both manual and system-driven close activities, we also have the qualitative context that support the numbers themselves.

The availability of this comprehensive view cannot be overstated. Finally, Finance and Accounting personnel have the broad and deep view into the status the close that they have always wanted. OneStream clients are already recognizing the benefits of this new transparency through reduced days to close, fewer rework requirements and tighter audits.